are acquisitions good for shareholders

An acquisition can help to increase the market. Some studies have found a positive effect of acquirers CSR on acquisitions such as faster deal completion Deng et al 2013.

Mergers And Acquisitions Easy Basics For Beginners

Are acquisitions good for shareholders.

. Announces 738 Shareholder Backing for Flora Growths Acquisition of the Company Read full article November 10 2022 530 AM 7 min read. When one company acquires another the stock price of the acquiring company tends to dip temporarily while the stock price of the. Why are acquisitions good for shareholders.

An acquisition can help to increase the market share of your company quickly. It is not uncommon for the acquiring companys shareholders to sell their shares and push the price lower in response to the company paying too much for the target company. Convincing Shareholders An Acquisition Is Transformational.

The Canadian cannabis producer has been adding pot shops to its. 1 hour agoSNDL SNDL 959 has been active when it comes to mergers and acquisitions over the past few years. When one company acquires another the stock price of the acquiring company tends to dip temporarily while the stock.

Stock deals significantly underperform cash deals. To put the acquisition in context the deal values Figma a ten-year old company at just over 10 of what Adobes pre-announcement market cap was 174 billion. Hawn 2013 lower deal uncertainty Arouri et al.

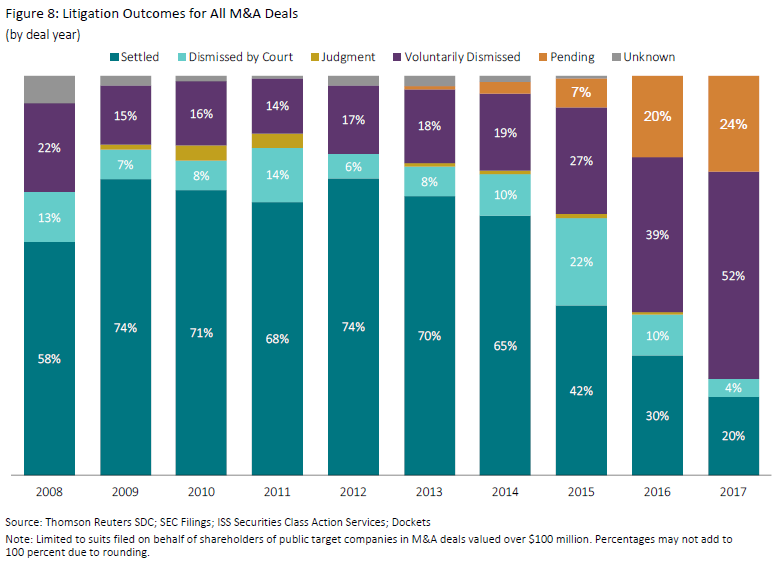

Small firm shareholders earn systematically more when acquisitions are announced. A closer look at our ownership figures suggests that the top 12 shareholders have a combined ownership of 51 implying that no single shareholder has a majority. Matos found that companies with a large percentage of high-turnover shareholders sold themselves in mergers at a discount.

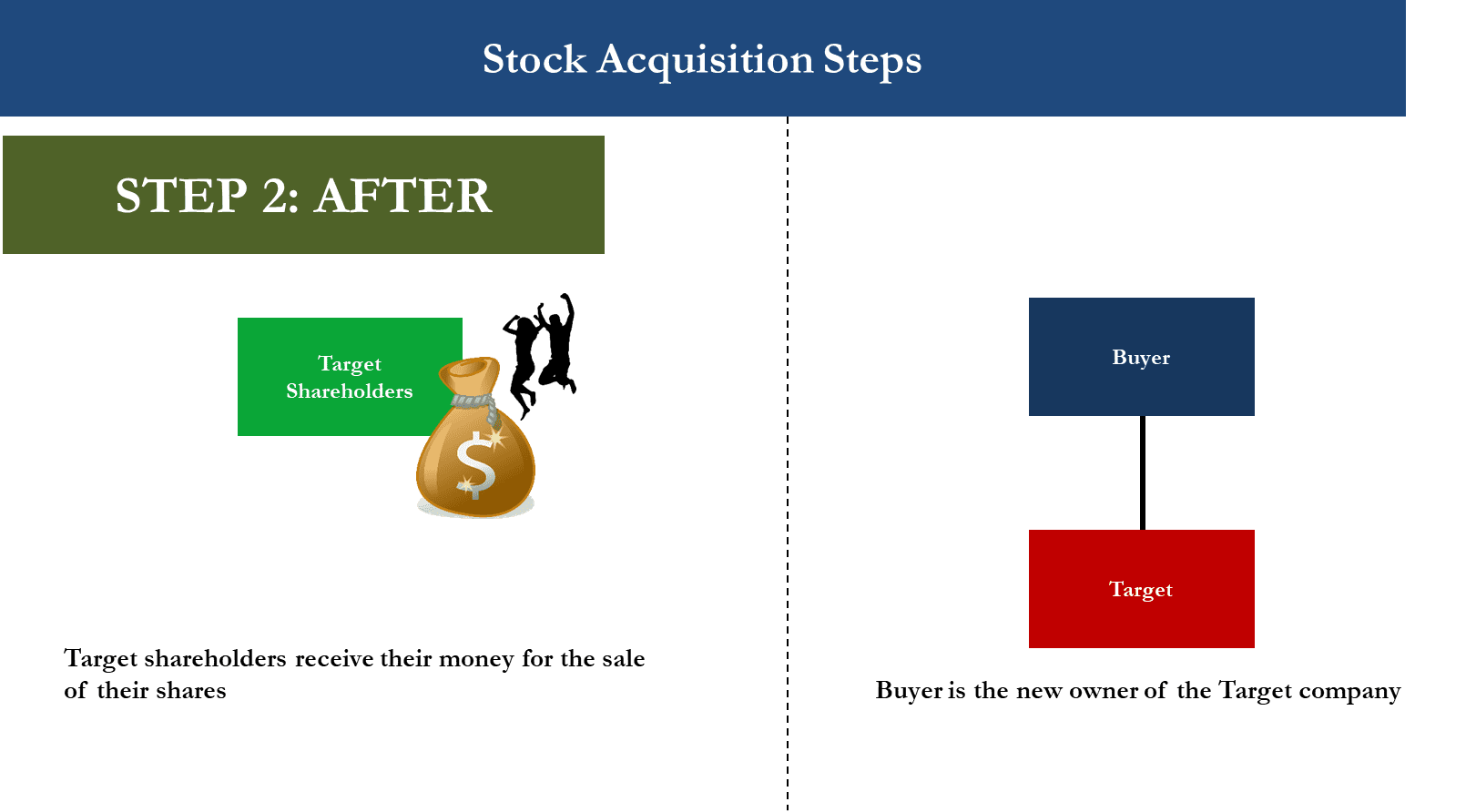

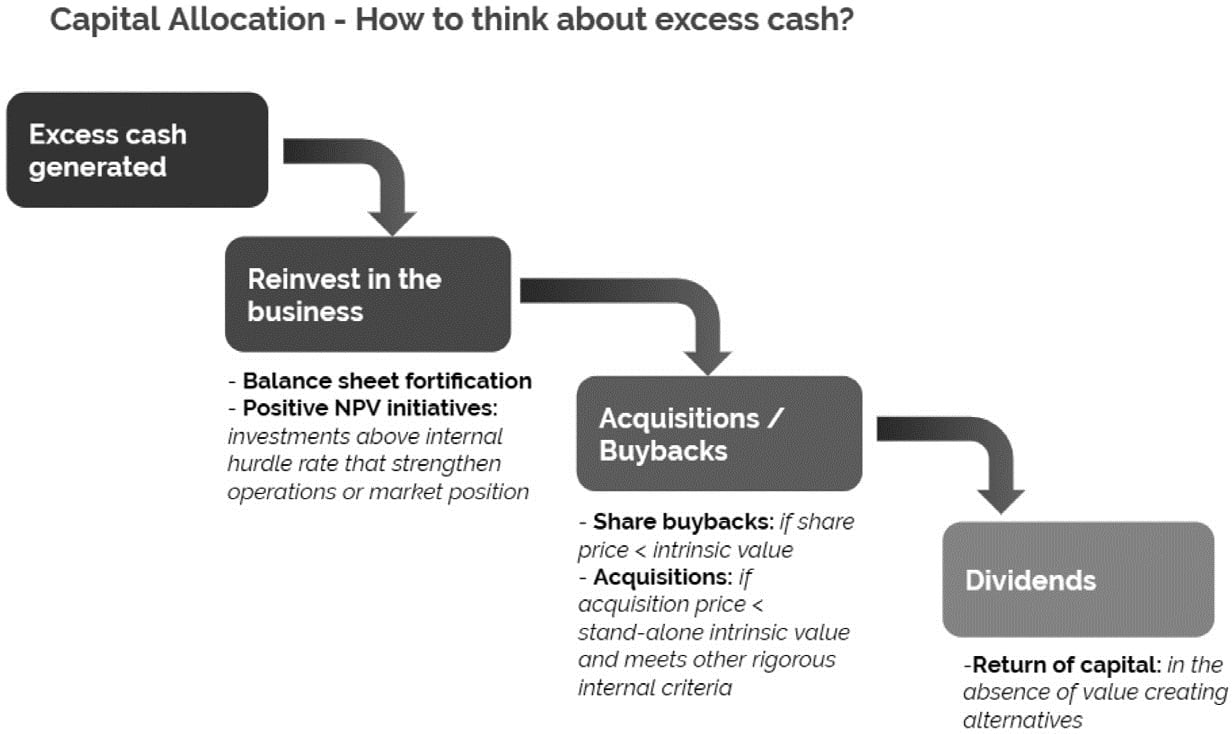

One of the key aspects of mergers and acquisitions is determining the governance structure and necessary approval mechanisms associated with the possible director and. Companies often merge to boost shareholder value by entering new markets or gaining greater share in those where they already compete. Do shareholders benefit from acquisitions.

Even though competition can be challenging growth through acquisition can be helpful in. A study by José Miguel Gaspar Massimo Massa and Pedro P. With shifting global market dynamics rapid advancements in technology and evolving customer demands.

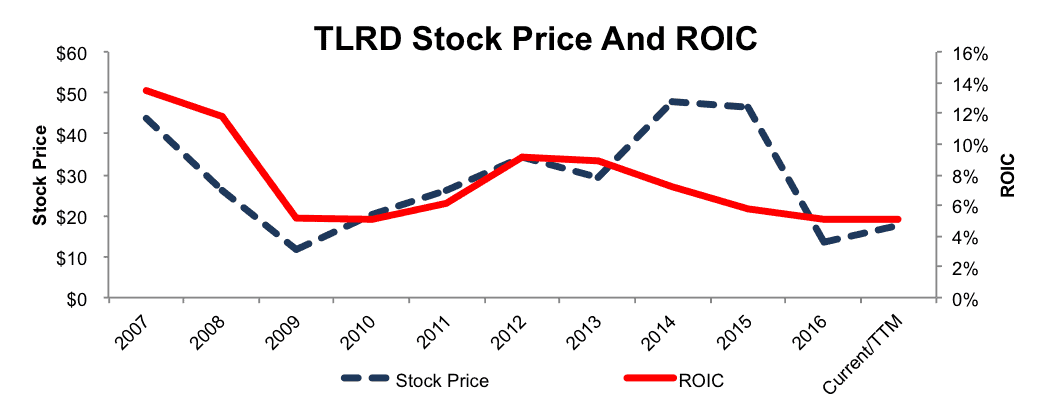

This size effect is typically more. Acquirers lag industry peers on a variety of fundamental metrics for an extended period following an acquisition. 1 hour agoSNDLs business can get broader and more diverse with the acquisition of Zenabis assets but whether it will pay off for the company is questionable.

The acquisition is great for Microsofts shareholders as Microsoft is able to deploy its cash holdings more meaningfully gaining a foothold in this segment with the acquisition and. 23 hours agoFranchise Global Health Inc. Mergers are more likely than.

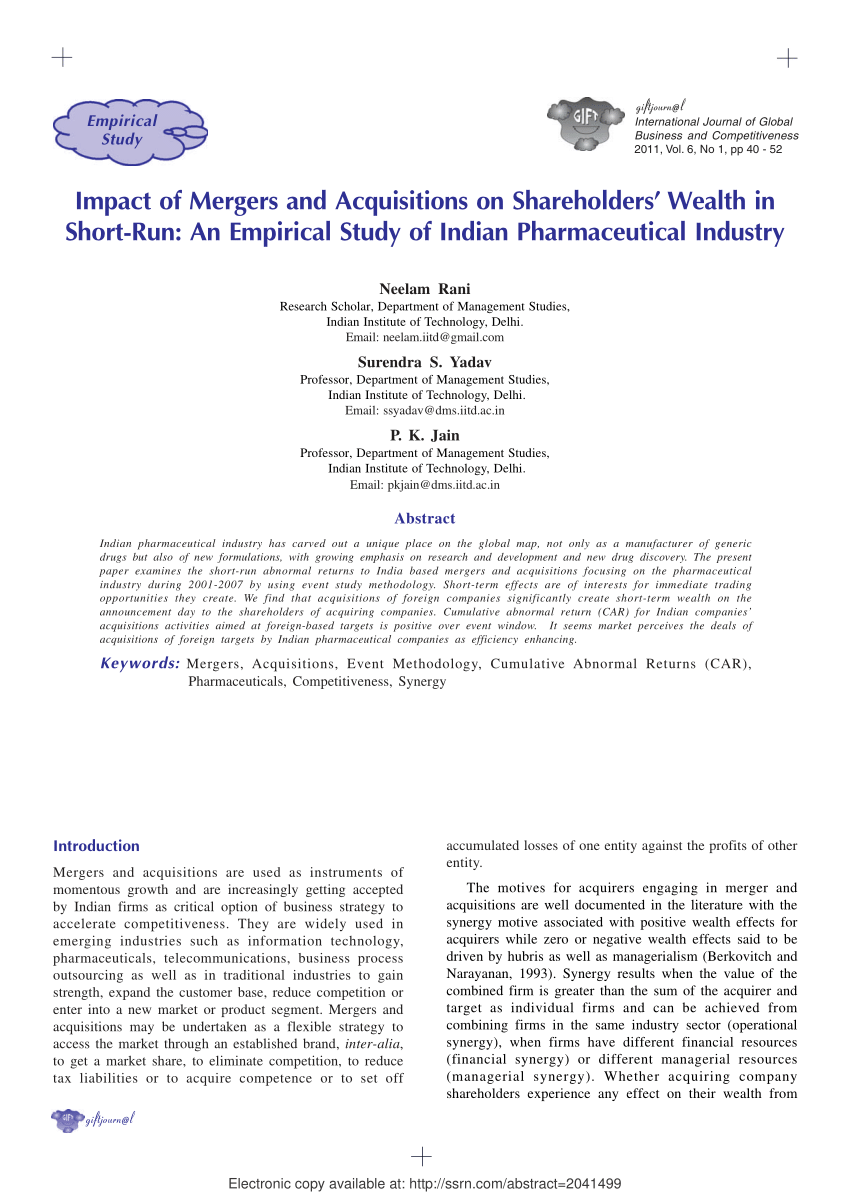

It has also been concluded that the shareholder value is affected negatively as a result of the mergeracquisition in the short-run.

Swell Of Mergers Acquisitions Likely To Affect Consumers Workers Sun Sentinel

Solved Clear My Cholco Question 12 The Basic Category Of Chegg Com

European Bank Mergers And Acquisitions Do They Create Value For Shareholders Starova Hana Teply Petr 9783639238747 Amazon Com Books

Why Companies Overpay For Acquisitions

With Linkedin Microsoft Looks To Avoid Past Acquisition Busts The New York Times

Basic Structures In Mergers And Acquisitions M A Different Ways To Acquire A Small Business Genesis Law Firm

How Company Stocks Move During An Acquisition

Do All Mergers And Acquisitions Require Shareholder Approval Stevens Law Firm

Shareholder Litigation Involving Acquisition Of Public Companies Review Of 2017 M A Litigation

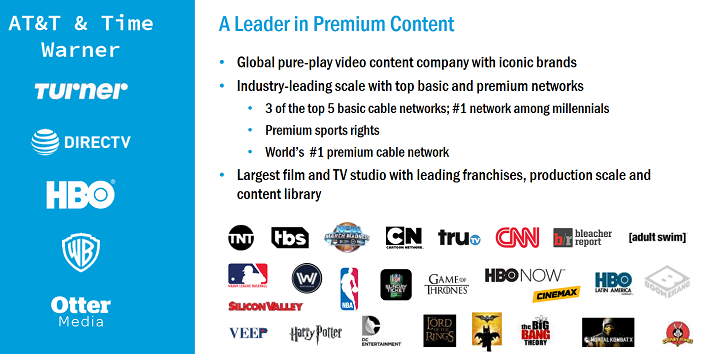

Is At T S Time Warner Acquisition Beneficial For Shareholders Nyse T Seeking Alpha

Deal Accounting In M A Simple Process Walkthrough

A Study On The Impact Of Mergers Acquisitions On Shareholders Wealth And Efficiency Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On

Do More Mergers And Acquisitions Create Value For Shareholders Request Pdf

Discipline And The Dilutive Deal

Quality Shareholders Valuewalk

4 Advantages Disadvantages Of Remaining A Shareholder After An Acquisition

Tender Offer Vs Merger One And Two Step Mergers

Pdf Impact Of Mergers And Acquisitions On Shareholders Wealth In Short Run An Empirical Study Of Indian Pharmaceutical Industry

Pdf Mergers And Acquisitions Value Creation For Shareholders Warren Loo Academia Edu