capital gains tax changes 2021

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. First deduct the Capital Gains tax-free allowance from your taxable gain.

Perspective Biden To Seek Tax Changes On High Earners Capital Gains Some Businesses Lvb

Weve got all the 2021 and 2022 capital gains.

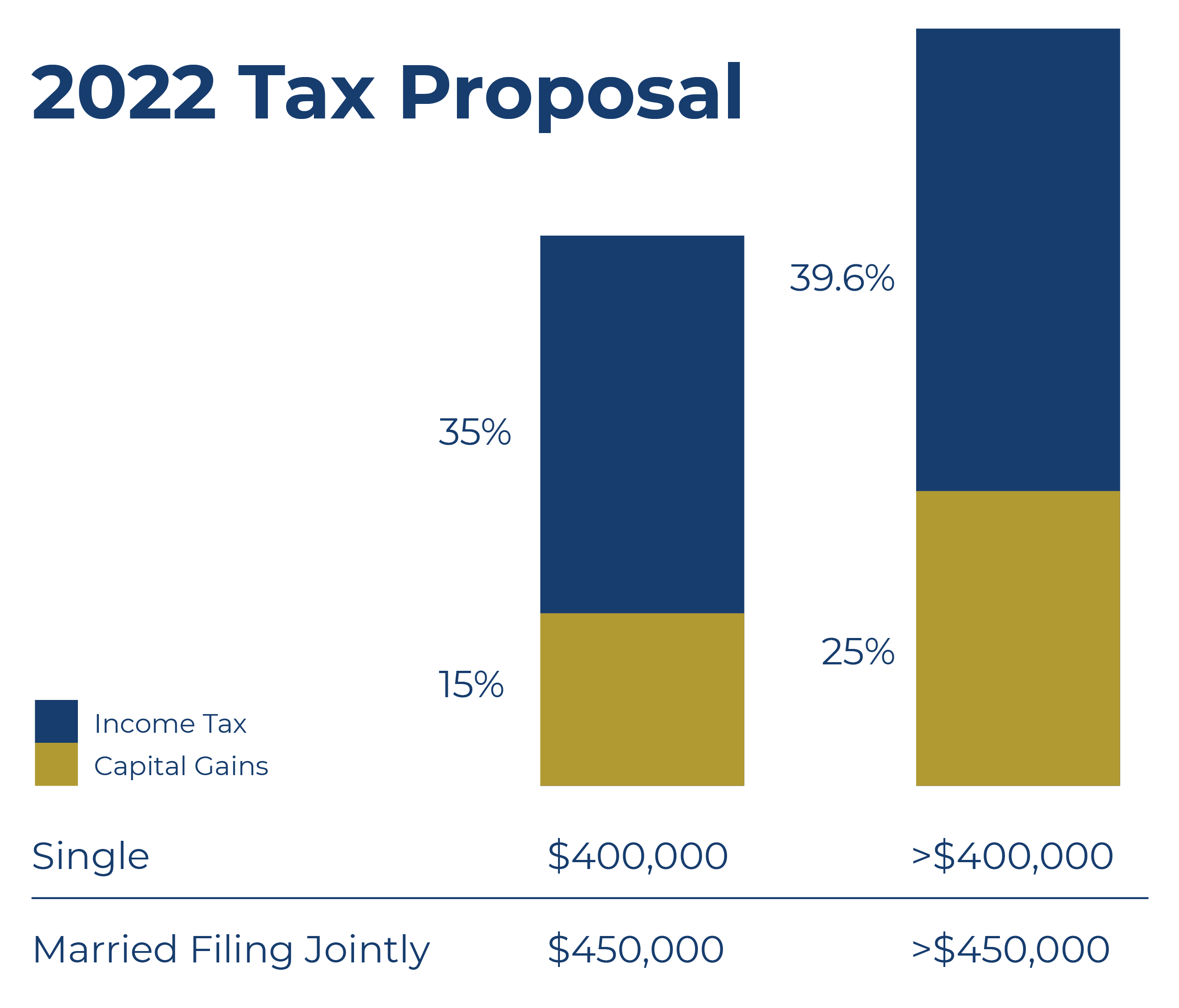

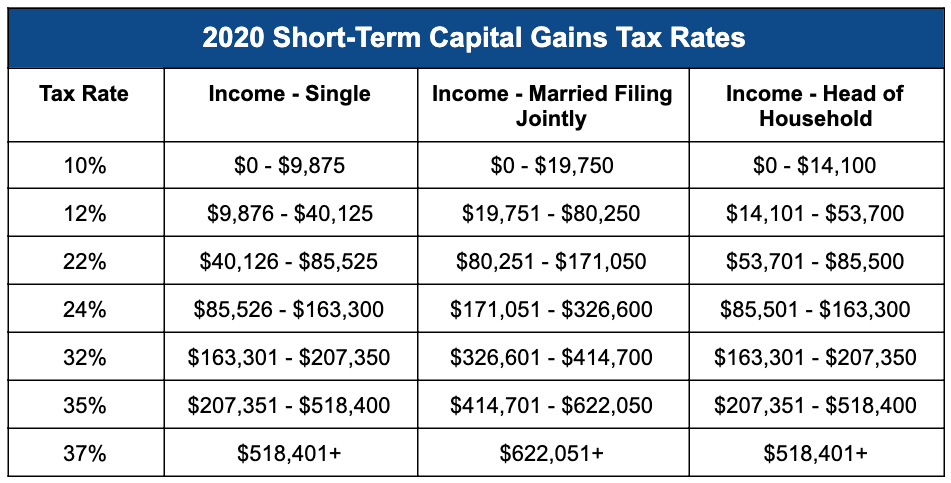

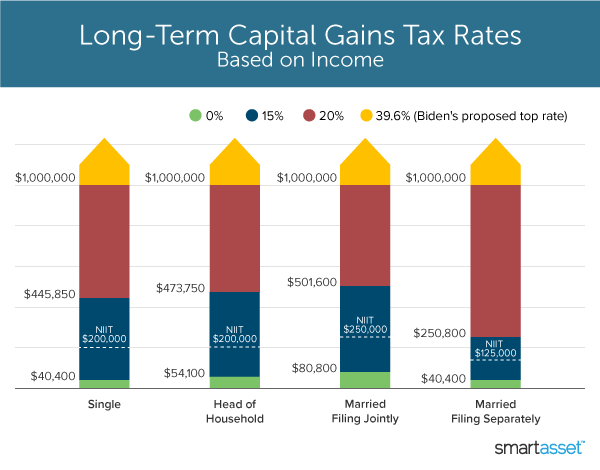

. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The individual tax rate could just from 37 to 396 for those making more than 400000 annually.

The changes only apply to tax year 2021. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25.

With average state taxes and a 38 federal surtax. The current capital gain tax rate for wealthy investors is 20. Additionally the 1M500K thresholds would be indexed for inflation after 2022.

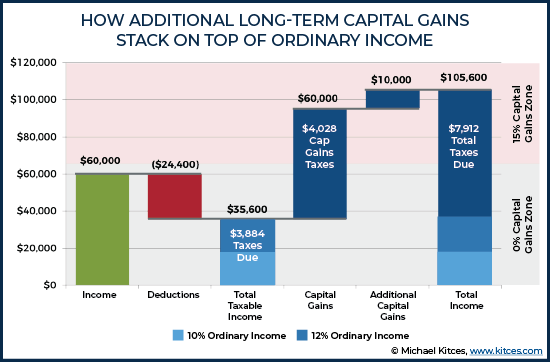

And a significant increase in the tax rate on. Raising the top capital gains rate for households with more than 1 million. Adding the 38 Net Investment Income Tax NIIT results in a combined rate of 408.

Capital Gains Tax Rates. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

However it was struck down in March 2022. On April 28 2021 Joe Biden proposed to nearly double the. 2021 US Capital Gains Tax Changes - Alpen Partners AG 1 week ago The current capital gain tax rate for wealthy investors is 20.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for. Investors Relief which applies to gains made on the disposal of investments in ordinary shares may come to an end effectively cutting the Capital Gains Tax by 50 to 10.

The effective date for this increase would be September 13 2021. The maximum rate would be 288 when combined. Colorado taxpayers can be exempted from paying state taxes on capital gains in.

The current capital gain tax rate for wealthy investors is 20. Long-term gains still get taxed at rates of 0 15 or 20 depending. It is fully available and refundable to households with no income unlike the Child Tax Credits former design.

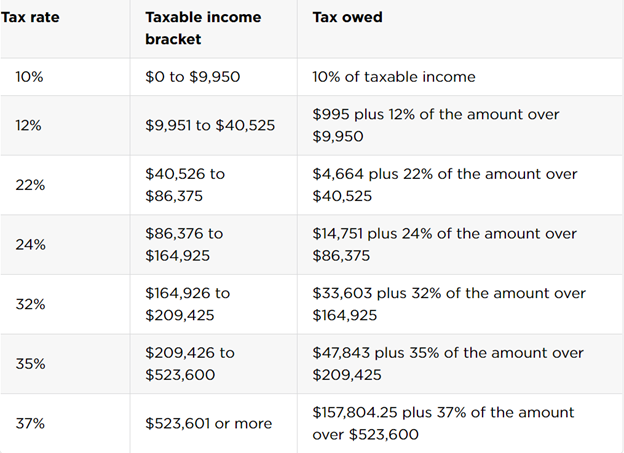

In April 2021 the president addressed the public with a speech and subsequent fact sheet outlining his proposed American Families Plan. Add this to your taxable. There are seven federal income tax rates in 2023.

House Democrats proposed a top federal rate of 25 on long-term capital gains by the House Ways and Means Committee. Annual exemption and rates of tax. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The current long term capital gain tax is graduated. Its one of the biggest tax changes in more than a decade for Colorado. You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451.

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Short Term And Long Term Capital Gains Tax Rates By Income

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Crypto Capital Gains And Tax Rates 2022

What S In Biden S Capital Gains Tax Plan Smartasset

President Biden S Capital Gains Tax Plan Forbes Advisor

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The Tax Impact Of The Long Term Capital Gains Bump Zone

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat

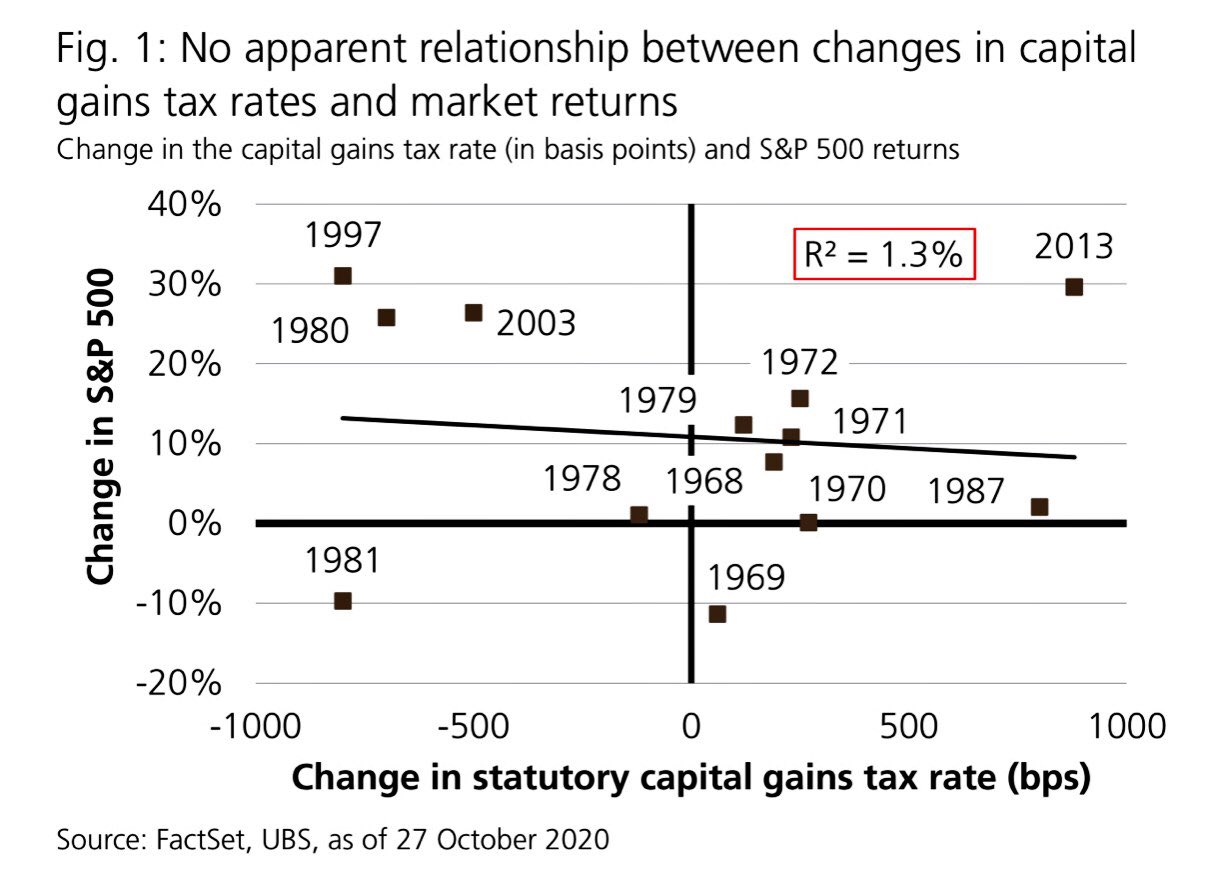

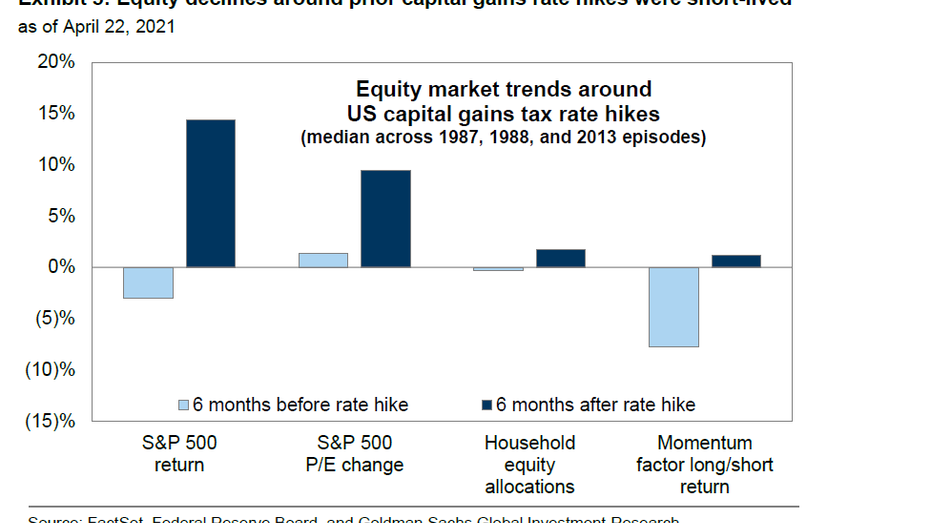

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Capital Gains Tax Hikes And Stock Market Performance Fox Business